Everyone's Waiting for 2025 Q4 to Save Them. It Might Not.

For years, Q4 has been the "make-or-break" quarter for D2C brands. It's when Black Friday, Cyber Monday, and holiday demand flood the system - the last, best shot at hitting annual targets and clearing inventory.

But this year, the pattern may break. The early data points toward a softer Q4, one where simply "showing up with spend" won't be enough.

The Early Warning Lights

Economists are flashing caution across multiple indicators:

- S&P Global has cut its U.S. GDP growth forecast to ~1.5% for 2025, citing weaker consumer demand, tighter credit conditions, and ongoing policy uncertainty (S&P Global Outlook, April 2025).Their latest reports call this "below-trend growth," driven by fragile household spending and elevated debt servicing costs.

- Equiti's Q4 macro analysis echoes that sentiment, forecasting 1.0–1.5% quarterly growth — almost a full percentage point below last year's pace.The culprit? "Weaker discretionary spending, subdued housing activity, and slower inventory accumulation" (Equiti Q4 2025 Outlook).

- The Conference Board projects U.S. GDP growth of just 1.6% for 2025 and 1.8% for 2026 — below the historical average and potentially the weakest expansion since pre-pandemic years (The Conference Board Economic Forecast).

What This Means for DTC Brands

Lower growth doesn't mean zero growth — but it does mean efficiency wins.

Brands that assume BFCM will "make up for a slow year" may find themselves over-invested in a quarter that delivers less than expected.

In an environment like this:

- Acquisition costs stay elevated

- Conversion rates compress

- Discounts eat margins that were already thin

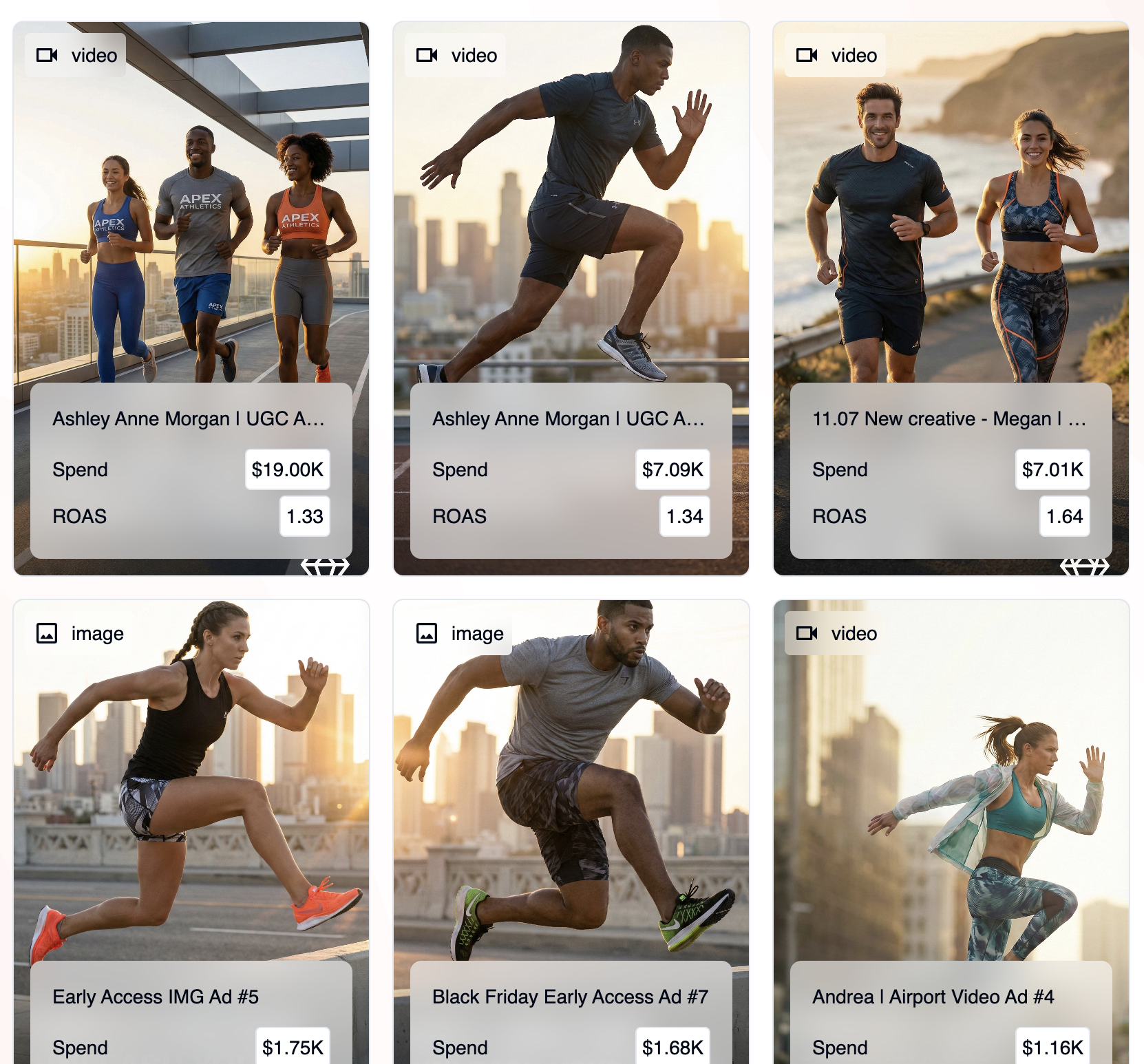

The Creative Intelligence Edge

When macro headwinds are real, creative becomes the lever. Brands that know which messages resonate — and can double down quickly — will outperform those still guessing.

That's where upspring.ai comes in. Our platform surfaces what's working in your creative — before you burn budget learning from failure.

In a year where Q4 may not save you, creative intelligence might.